Welcome to The Carlisle Group's Knowledge Base.

Search or Ask a Question

This is a keyword search that looks for matching articles that contain one or more words specifically by a user in articles’ tags, title and content. Admin writes brief intro content here via admin end. If you are unable to find an answer to your issue, please submit an issue here.

Portfolio Optimizer | CAS

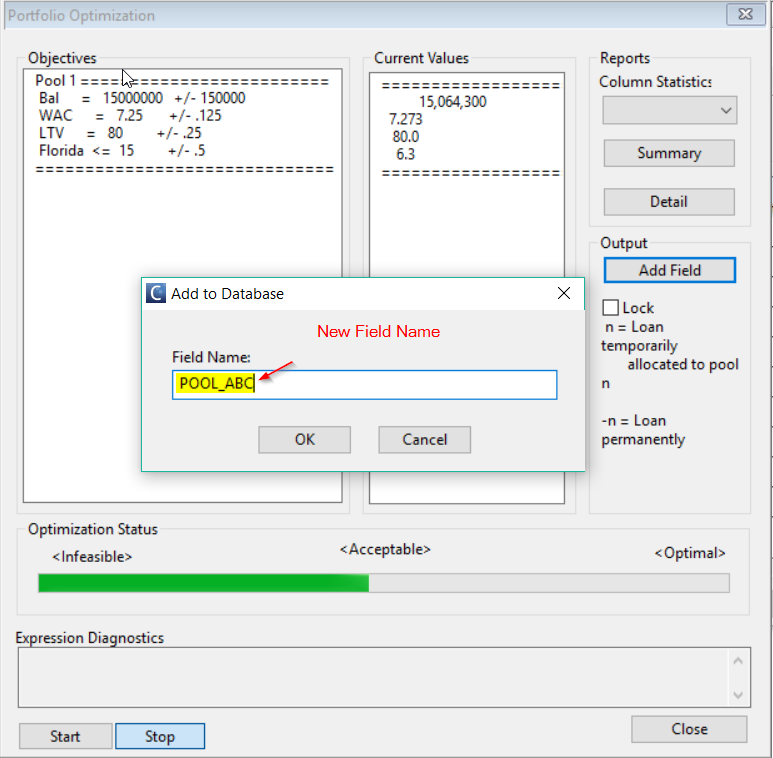

Added: 06/02/2016; Last Modified: 11/22/2021; Visits:2,248The CAS Portfolio Optimizer can create a pool of records with targeted summary characteristics. A client might want a pool of $15m of loans with a 7.25 WAC, 80 LTV, and no more than 15% Florida properties.

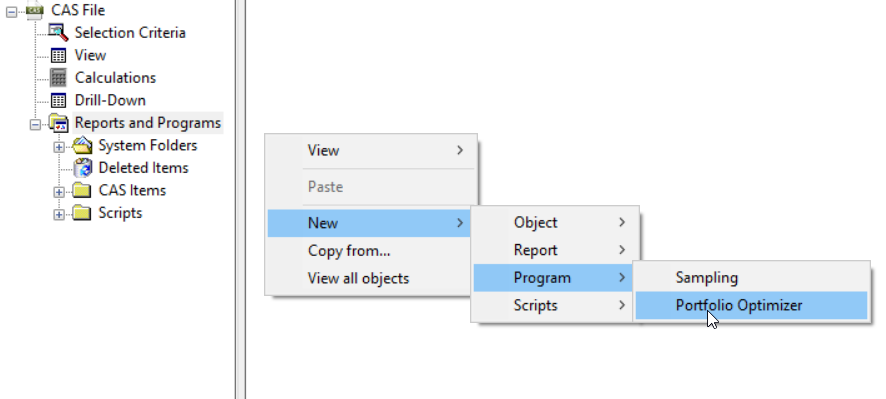

Create a new Portfolio Optimizer:

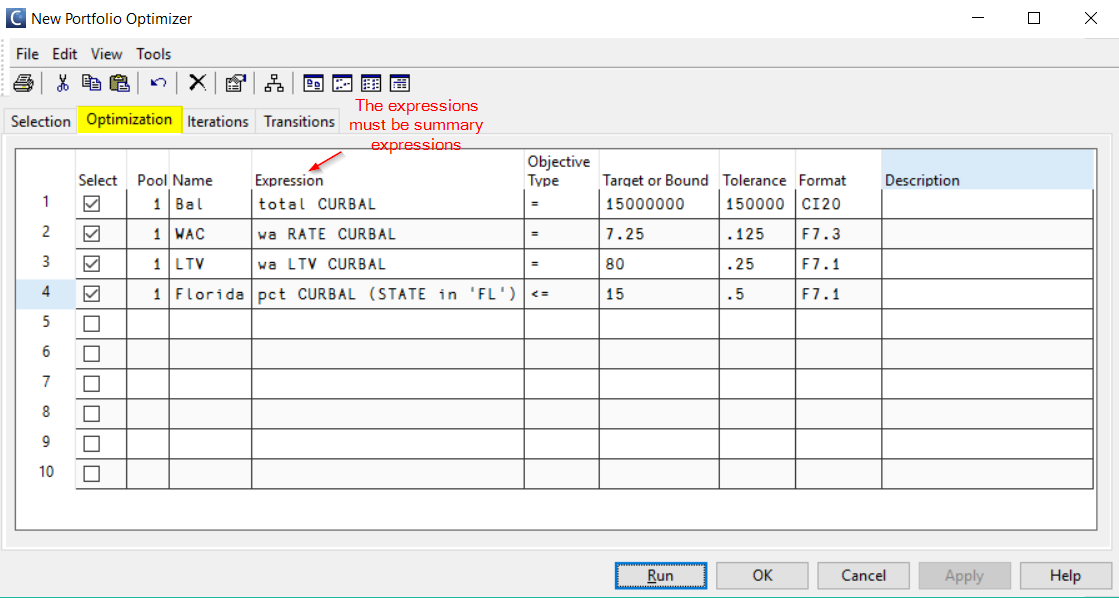

Enter the Summary Stats you want to target for your new pool on the Optimization tab. Then enter the operator and the target for each of those stats and a tolerance. The Format is used to display the summary results when finished. The Pool Column must be some number greater than 0 and should be the same if you are just trying to produce 1 optimized pool. Click "Run".

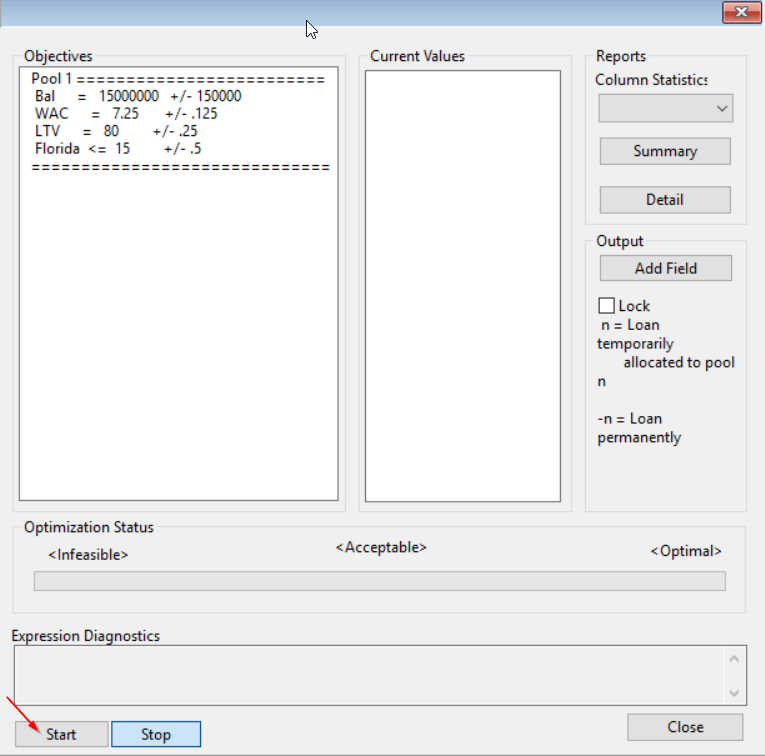

The Objectives are displayed. Click "Start"

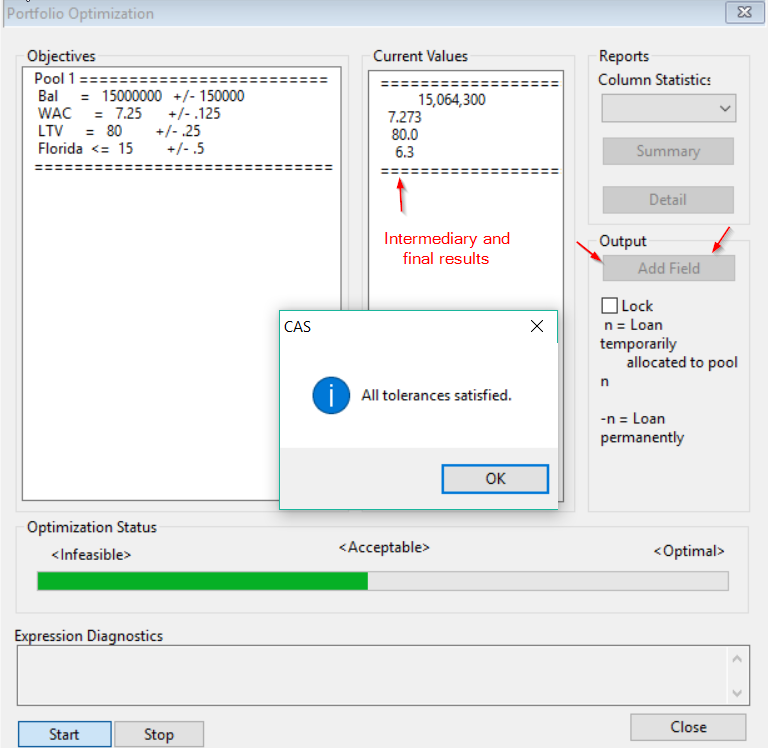

The Optimizer runs through a minimum number of iterations (set on the "Iterations" tab) and displays current results at each iteration. The progress bar should move from Infeasible to Acceptable. When it stops running, click "Add Field" to add a field to your file which will flag the resulting "optimized" pool.

The Field "POOL_ABC" is created. To look at loan level detail or to run reports with this new pool, use the selection statement: POOL_ABC = 1

The optimizer works best with evenly distributed data. If you have data that is weighted heavily in one direction or barbelled, it would be faster to use the Sampling object to sample out the weights to make the data more even, then run the optimizer off of the remaining data.

Keywords: Optimize Target Constraint Objective